Notes from the Iraq Oil Conference

I recently went to London to an Iraqi oil conference. Below you will see my notes, but first let me give you a little background.

First you should know that countries coming off of civil wars are very lucrative to early investors. After the brutal civil war in Sri Lanka ended in 2008, the benchmark Colombo All Share index went from a 2008 low of about 1,500 to a 2011 high of nearly 7,800.

This type of move happens with the advent of peace and prosperity. Colombia’s stock market gained about 5,000% after the narco traffickers were soundly defeated. The end of apartheid in South Africa and the fall of the USSR brought similar gains to those countries’ stock markets.

Bullish on Iraq

Iraq is considered to have the world’s second-largest proven oil reserves with 140 billion barrels. That number is expected to rise, as much of the data is based on 2D seismic surveys and predates the 2001 war.

Firms like Gazprom say they can get the oil out of the sands in Iraq at $3.50 a barrel, a price that can only be beaten by the Saudis. Iraq recently surpassed the Saudis as the number one exporter to India.

Yet this wealth of low-cost oil gets very little play in the global news, as ISIS has been running amok for the past few years. This is starting to change. ISIS is on its last legs, and some 3 million people are returning to their homes from liberated cities like Mosul.

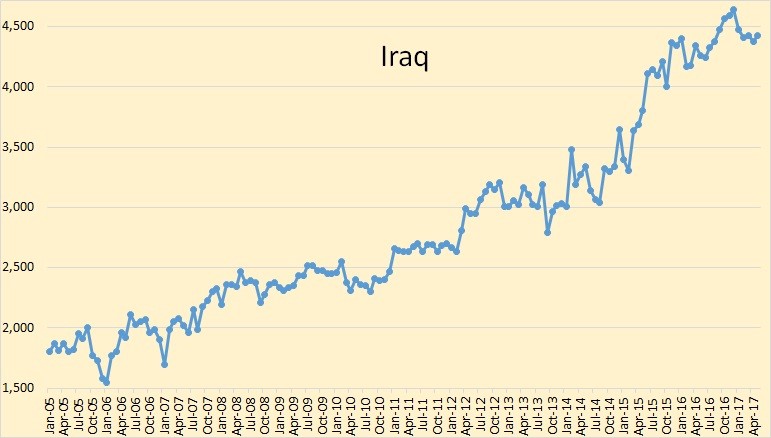

As you can see by this chart, Iraqi oil production continues to climb and is now more than double pre-war output.

Iraq, as part of OPEC, has agreed to cut oil production by 210,000 barrels a day to 4.351 million until the end of the year. Oil accounts for 90% of the government revenue.

According to the Iraq Business News, there are a number of oil companies in Iraq, including BP, CNOOC, CNPC, Dragon Oil, Egyptian General Petroleum, Eni, ExxonMobil, Gazprom, Inpex, Shell, Total, and Turkiye Petrolleri.

Iraqi Kurdistan has about five companies listed outside Iraq. These include DNO ASA (Oslo: DNO) and Genel Energy Plc (LSE: GENL).

A smaller company, Kuwait Energy, is seeking a London IPO in an attempt to raise $150 million. The company produces 27,000 barrels a day from its holdings in Southern Iraq.

Iraq has a stock market based on the NYSE that has over 80 companies.

Iraq is the fastest-growing country in the Middle East. Its GDP grew 11% last year. Its debt is rated stable at “B”. Inflation is low at 2.2% but expected to go up this year. The dinar is steady and pegged to other currencies.

The private banking sector is underdeveloped in Iraq and could see substantial growth.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

What I Learned in London

Here are some thoughts about the London Conference, which coincided with the Ariana Grande concert terrorist attack. Many speakers prefaced their talk with a word of support for the London victims.

London is beautiful, at least around the Trafalgar Square area and the South Bank. Like any large international city, it is full of tourists, foreign nationals, and locals alike. The weather at the time was 72 and sunny, much like San Diego. Londoners love to talk about the weather for some reason.

The city is clean, but the homeless are everywhere, living in cardboard boxes and new sleeping bags. Most are young men, with drug addictions and hipster beards.

A half-hour walk will show you statues of heroes from a previous age, from Captain Cook to Lord Nelson to writers like Shakespeare, Keats, Wilde, and Woolf. There was even one of Oliver Cromwell. I didn’t see anyone trying to rip it out like they are doing to poor Robert E. Lee in the States.

Of course, there were also big lions and fountains and that goofy Ferris wheel.

Back to Oil

There was plenty positive to say about oil and oil production.

The conferees seemed surprised that they were selling Basrah Heavy to U.S. refineries to replace the heavy oil that is no longer coming from Venezuela.

The Iraq oil minister complained about the global glut of oil and said that U.S. frackers should cut production. The panel said it would never happen, as there are thousands of producers. Forty years ago, the U.S. used to set prices with the Middle East, but then there were embargos in the 1970s. The Seven Sisters are dead.

I loved hearing the head of Gazprom in his Russian accent tell the Iraq oil ministers that they have competition from Nigeria and Colombia and everywhere else on earth and that if they set the costs too high in terms of the government split, oil companies simply won’t invest.

You have to love Russia giving lessons in capitalism.

It should be noted that there were no American companies there despite so much blood and treasure spilt by this county. Turns out there was “no war for oil” after all.

Other Bits

The country is flaring 85K barrels equivalent of natural gas a day. This is an opportunity, as its neighbors including Saudi Arabia want to move from using oil in electric power plants to natural gas. Kuwait is a gas importer.

There is talk of building gas hubs and eliminating flaring over the next five years. Basrah Gas Company has partnered with Shell and Mitsubishi to move this along.

It should be noted that natural gas is not a part of OPEC.

There was a great deal of optimism overall. The vast majority of the people in attendance were Iraqis.

One attendee I had lunch with supplies pipes and valves to oil companies in Iraq (and Texas). He said, “Christian, even when I had to crawl over bodies to get to work I was optimistic.” That puts things in perspective.

There were talks about the World Bank and IMF funding infrastructure projects. These seem well advanced. One problem is getting people to pay for electricity.

There are private equity funds, a working stock exchange, and working banks.

The companies on the stock exchange are worth a total of $500 million, which is nothing. Twenty percent of Iraqis have bank accounts, and the banking infrastructure is poor after a quarter-century of wars. ATMs are few. The upside in banking is huge.

When I invest in emerging markets, I look for banks, telecoms, oil plays, and breweries. In Iraq, banks seem to be the best bet. After peace, the foreign direct investment will flow through the banks in the billions.

Everyone at the conference had good things to say about Prime Minister Haider al-Abadi. He seemed to be viewed as able to bring the various fractions together.

In the security session, a former British Victoria Cross winner and CEO of a security firm complained about competition, the rise in costs, and the desire of his clients for total security when it was no longer needed. The point I got from this was that Baghdad is safer than foreigners give it credit for.

Though they also said ISIS would likely go on in some form in the hinterlands for years.

If you are looking for a buy on the bottom with huge upside that isn’t correlated to the S&P 500, Iraq is your place.

I’ll be advising my readers on what to buy. Join us here.

All the best,

Christian DeHaemer

Christian is the founder of Bull and Bust Report and an editor at Energy and Capital. For more on Christian, see his editor’s page.